Maximize Homeownership Potential with Down Payment Assistance Guide

Popular Programs

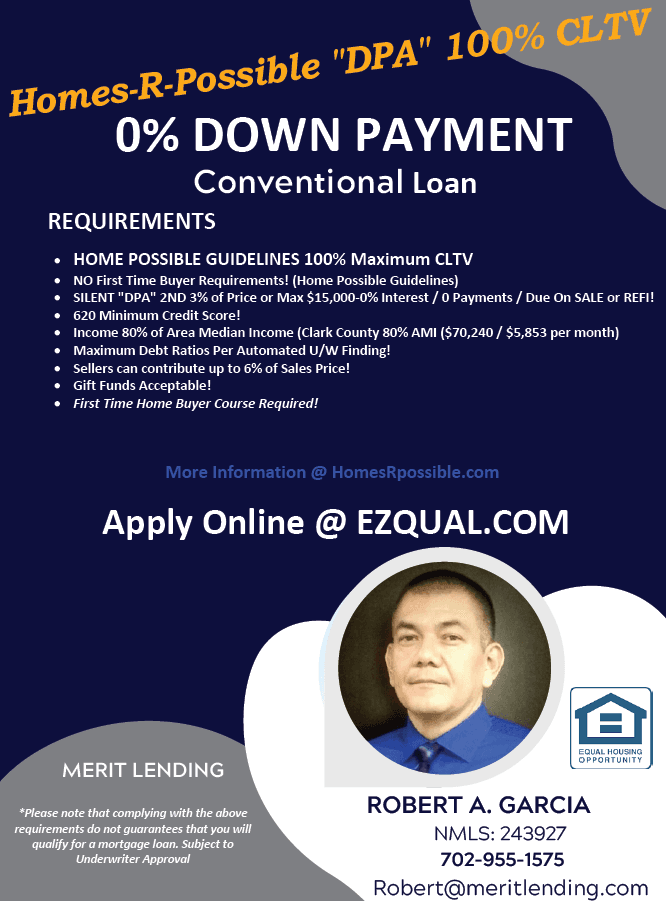

Homes-R-Possible-DPA

3% DOWN MAX $15,000

Income Limits-80% AMI

620 Minimum Fico

No FTHB Requirement

EPM-100 FHA

3.5% DPA FREE MONEY!

3.5% DOWN PAYMENT GRANT!

No Income Limits!

620 Minimum Fico

No FTHB Requirement

DO NOT LET LACK OF DOWN PAYMENT KEEP YOU FROM CREATING WEALTH WITH REAL ESTATE!

First-time homebuyers often encounter several common challenges when entering the housing market, including:

1. **Affordability**: Rising home prices and higher interest rates can make it difficult for buyers to find properties within their budget.

2. **Limited Inventory**: A competitive market may lead to a shortage of available homes, making it challenging to find suitable options.

3. **Understanding Financing**: Navigating mortgage options, down payment requirements, and closing costs can be overwhelming for first-time buyers.

4. **Credit Issues**: Many first-time buyers may face challenges related to credit scores, which can affect their loan eligibility and interest rates.

5. **Inspections and Repairs**: Understanding the importance of home inspections and budgeting for potential repairs can be daunting for new buyers.

6. **Emotional Stress**: The home-buying process can be emotionally taxing, with uncertainty and pressure to make quick decisions.

7. **Lack of Experience**: First-time buyers may not be familiar with the home-buying process, leading to potential missteps and confusion.

8. **Long-Term Commitment**: Purchasing a home is a significant long-term financial commitment, which can be intimidating for many.